The Feast

Cost of Corporate Giveaways 2025

Big corporations gorge themselves on Florida’s economy—stuffing their pockets with profits, chewing through our resources, and guzzling up our workforce like it’s an all-you-can-eat buffet.

But when the check hits the table and it’s time to pay for every greasy bite they slobbered down? They slip out the back door and stick hardworking Floridians with the bill.

It’s past time to send the tab where it belongs—and make the corporate elite pay for their feast.

Table Of Contents

Introduction

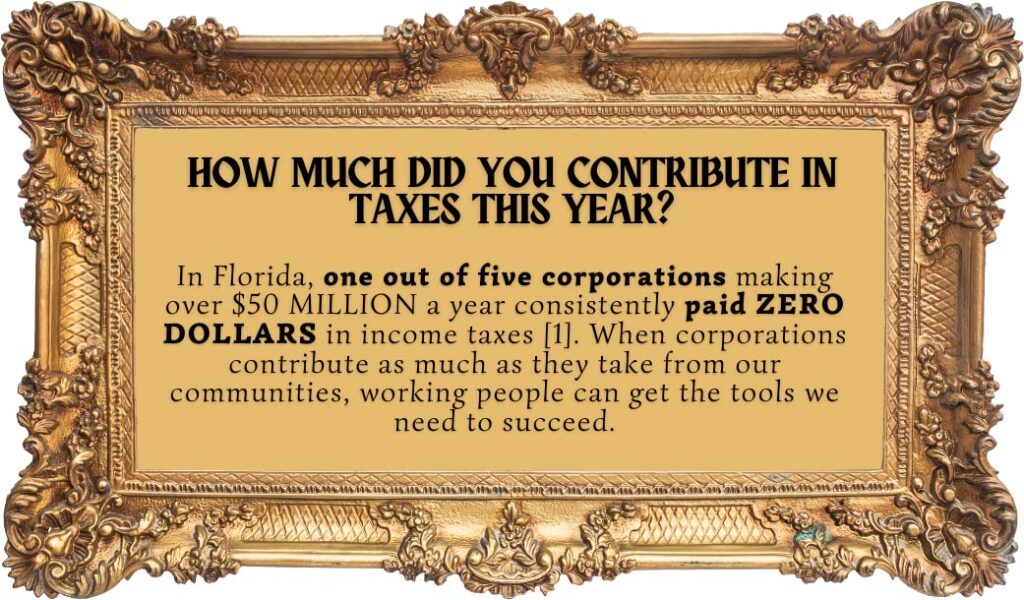

No matter what we look like, where we come from, or what we do for a living, Floridians work hard to put food on the table, care for our loved ones, and provide a good home for our families. We contribute to our communities in many ways, including by paying our taxes to help fund our neighborhood public schools, affordable housing, health care, clean water, and keeping our people safe. But while everyday Floridians are doing our part, greedy billionaires and their multinational corporations are cheating the system to dodge billions in taxes and deprive our communities of the critical resources we need to thrive.

This is largely due to the fact that politicians in Florida refuse to adopt a simple, common-sense tax policy called combined reporting.

During Florida’s 2025 Legislative Session, our elected officials are debating who should get tax breaks and how they should be implemented. No matter how that fight plays out, there’s a clear solution to Florida’s budget shortfall: closing corporate loopholes by finally adopting combined reporting and making multinational corporations pay in-state corporate taxes on their profits in Florida. When big corporations pay us what they owe, we can all have the essential care, services, and support our families deserve.

Corporate Elites Are Feasting—But Not Footing the Bill

Who's Benefiting From Florida's Corporate Tax Loopholes?

Florida is one of 17 states that still allows large corporations to shift profits to other out-of-state companies they own to avoid paying state corporate income taxes. This outdated loophole, known as “separate reporting,” lets massive corporations rake in record profits by starving our communities of the resources we need to fund essential programs and services like public education and healthcare.

This has allowed Florida to become a corporate tax haven, a profit paradise where a handful of ultrawealthy CEOs can lounge around and dodge paying what they owe while everyday Floridians show up to work everyday to provide for our families and create the wealth they are hoarding.

Unsurprisingly, Florida’s refusal to adopt combined reporting overwhelmingly benefits some of the largest and most profitable corporations. Here are some of the giant corporations that are charging high fees, paying low wages, and abusing tax loopholes to deprive OUR communities of the resources we need:

The Fine Print On The Menu

What Is Combined Reporting?

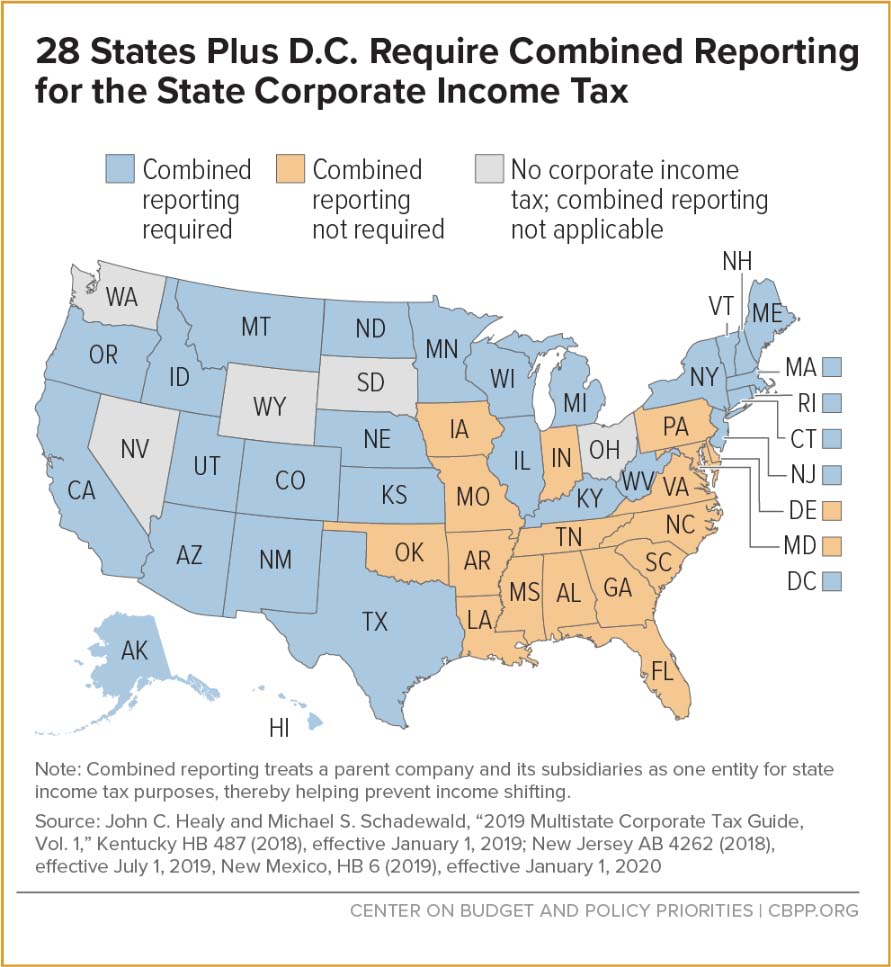

Combined reporting is a tax policy that prevents corporations from shifting profits they make in one state to affiliated companies in lower-tax states or offshore tax havens. It would require corporations to report all profits earned across their network of entities and pay state taxes based on the profits they make from their business activities in Florida. . 28 states plus Washington D.C have adopted combined reporting in order to close corporate tax loopholes and ensure fairness in the tax system. So why hasn’t Florida?

Combined reporting would make sure that large corporations like Target report the profits of all the companies they own on a single, unified tax return—reflecting the reality that these companies operate as one entity. This approach would make it much more difficult for profiteering corporate CEOs to shift profits around in order to dodge the taxes they rightly owe Floridians.

Unfortunately, over the years Florida’s Republican leaders have consistently declined to adopt combined reporting. Instead, they have sided with powerful business lobbying groups like Associated Industries of Florida—which represents major corporate campaign donors such as Florida Power & Light, HCA Healthcare, and Disney—and which pours millions of dollars into political bank accounts across the state every year.

The Massive Tab Corporations Leave Behind

How Much Are We Letting Corporations Get Away With in Florida?

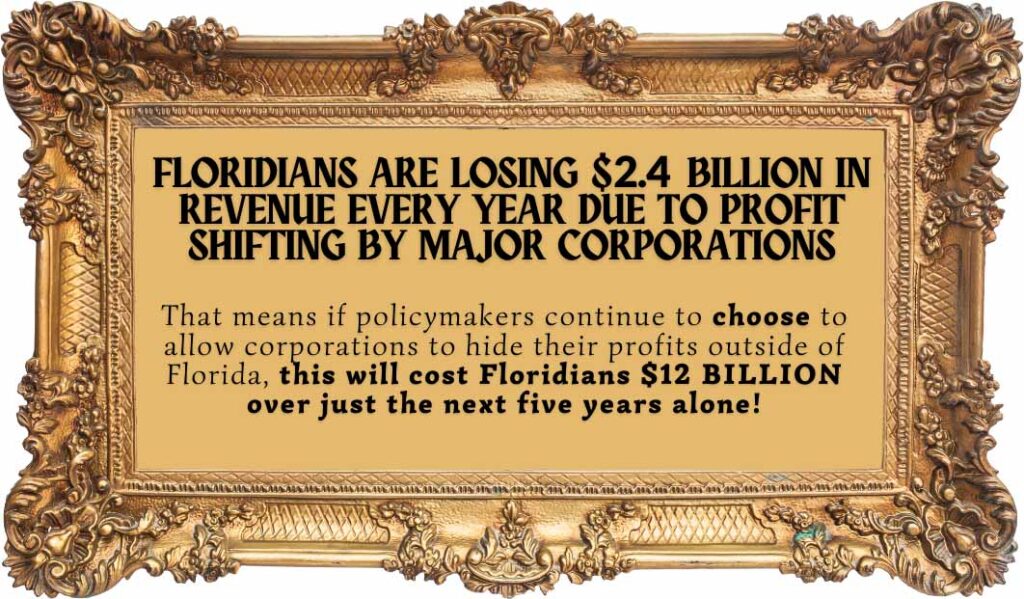

If Florida adopted combined reporting, the state could recover an estimated $2.4 billion in lost revenue annually. Florida has the 2nd highest potential of any state in the country for how much money we could gain by closing these corporate tax loopholes, increasing our corporate tax revenues by 41%. It’s a no brainer!

Everyday Floridians Picking up the Check

What Is The Real Price Floridians Pay?

While corporations avoid paying what they owe, the cost falls on working families, seniors, and small businesses. The lost revenue means underfunded public schools, higher property taxes, crumbling infrastructure, and rising health care costs. Florida politicians have chosen to side with corporate elite campaign donors instead of fixing this broken system.

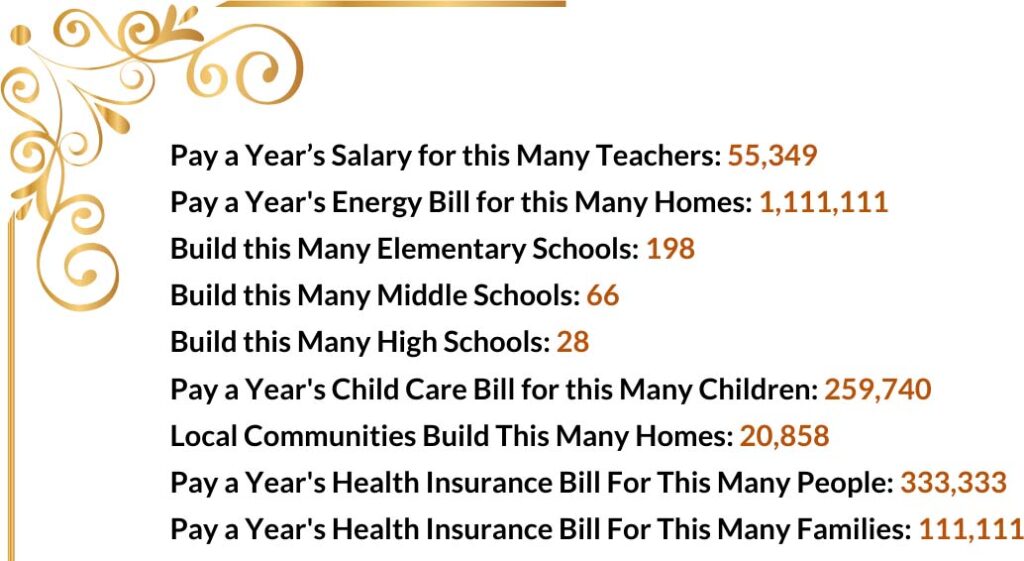

But with one simple policy change that ends offshore corporate tax havens, Florida could gain about $2.4 billion a year in tax revenue! If Florida lawmakers passed combined reporting to make corporations pay like the rest of us, here are some examples of what we could do with the $2.4 billion dollars in revenue. 👉

Send the Bill Where It Belongs

The Opportunity for Reform

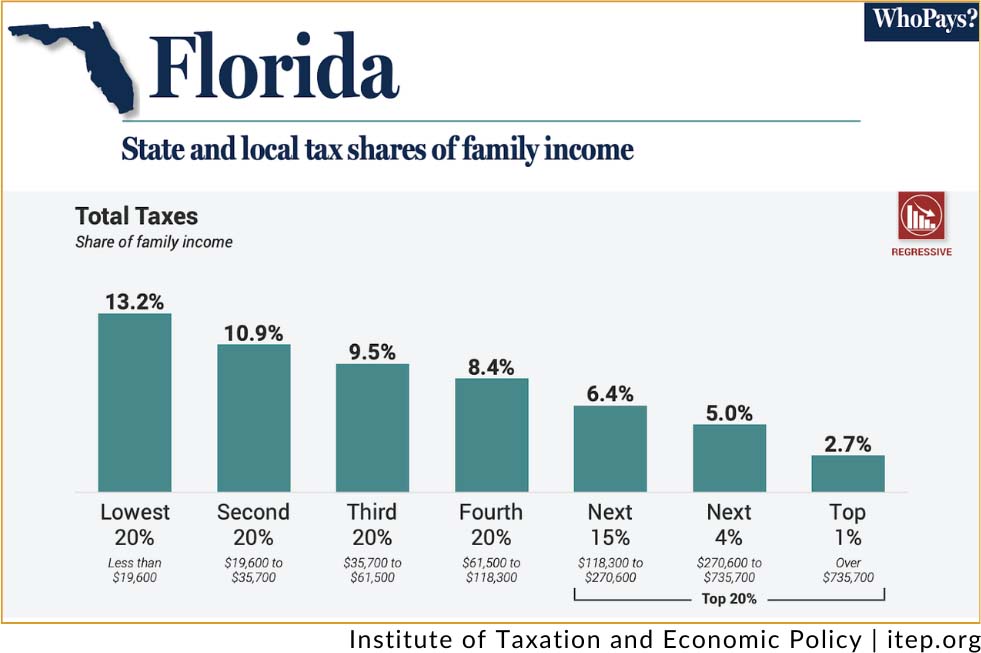

During Florida’s 2025 Legislative Session, the House passed a substantial cut to the statewide sales tax – dropping it from 6% to 5.25%. For context, Florida has the most upside down tax system in country, a regressive tax system that hits working- and middle-class families, as well as seniors on fixed incomes, the hardest. Our overdependence on sales tax – the most regressive tax there is – means that those with the least end up paying the most. In Florida, low-income families pay almost five times as much as wealthy families. This has been by design and the result of decades of policy choices that have intentionally shifted the burden to working families.

The proposal to reduce Florida’s regressive sales tax is a historic move towards a more fair tax system for working people and a step in the right direction. At the same time, tax cuts cost money, and how we choose to pay for them is critical. Funding a sales tax cut by slashing the very programs that help everyday Floridians would defeat the purpose entirely.

That’s where combined reporting comes in!

Floridians have a historic opportunity in front of us. When our elected officials choose to pair a sales tax cut with combined reporting, we will offer true tax relief to working Floridians and seniors by making multinational corporations pay what they owe.

Serving Up a Florida That Works for Everyone

No matter our background, job, or zip code, Floridians work hard to care for our loved ones and build a good life for our families. We contribute to our communities in countless ways, and we should all have the freedom to enjoy Florida’s natural beauty, spend time with those we love, and live the lives we’ve worked so hard to build.

But while everyday Floridians are doing our part, large multinational corporations are exploiting tax loopholes to dodge billions in taxes—robbing our communities of the resources we all depend on. Florida has become a corporate tax haven: a profit paradise where ultra-wealthy CEOs get to skirt the rules and hoard wealth, while the rest of us work hard to create it.

Floridians deserve a tax system that works for us—not just for billionaire CEOs and corporate shareholders. It’s time to close the loopholes and make sure big corporations pay what they owe our state, just like the rest of us.

Join the fight! When we shine a light on corporate tax avoidance and demand accountability, we can win a fairer tax system—one that puts people first.